Market analysis of intraocular lenses in ophthalmology

The relevance of research

Currently, intraocular lenses (IOLs) in India are widely used by visually impaired people and have a strong position in the global market. Intraocular lenses are the only known medical way to restore vision to a cataract patient.

Purpose of the study

Analysis of the state of the market for intraocular lenses in ophthalmology, assessment of the market size, analysis of competitors, as well as identification of factors affecting the IOL market.

Content

Part 1. Market overview of intraocular lenses (IOL) in ophthalmology in India

1.1. Main characteristics of the market

1.2. Assessment of factors affecting the market

1.3. Volume of domestic production

1.4. Share of exports in production

1.5. Market share of imports

1.6. Dynamics of market volume and capacity, 2013-2018 (2018 - forecast)

1.7. Market structure by types of products

Part 2. Analysis of imports in 2017

2.1. IOL import volume, 2017

2.2. Import structure:

2.2.1. By producing countries (in physical and value terms)

2.2.2. By manufacturing companies (in physical and value terms)

2.2.3. By recipient companies (in physical and value terms)

2.2.4. By trademarks (in physical and value terms)

2.3. Average import price

Part 3: Competitor Analysis

3.1. Major players in the market

3.2. Market shares of the largest competitors

Part 4. Consumption analysis

4.1. Analysis of consumer preferences

4.2. Dynamics of IOL implantation volume, 2013-2018 (2018 - forecast)

4.3. The volume of IOLs sold through tenders, 2013-2018 (2018 - forecast) by years (in physical and monetary terms)

Part 5. Price Analysis

5.1. Prices for domestic IOLs

5.2. Analysis of prices for imported products

Part 6. Consumption forecast until 2022

Part 7. Recommendations and conclusions

Research excerpt

Part 1. Market overview of intraocular lenses (IOL) in ophthalmology in India

1.1. Main characteristics of the market

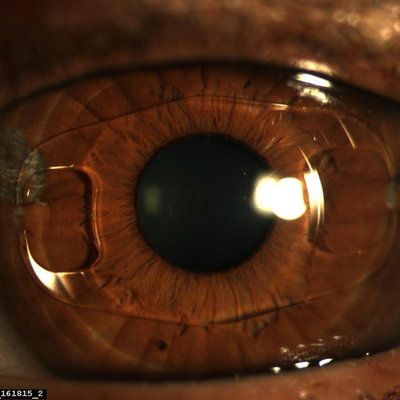

An IOL, or intraocular lens, is an artificial lens (optical lens) that is implanted in a patient instead of a cataract-affected lens. The main task of the IOL is to focus light on the fundus or retina. At this point, the light rays are converted into electrical impulses that enter the brain, where they are converted into images. If the light rays are not focused correctly on the retina, the brain cannot accurately process the images.

To date, this is the only way known to medicine to restore vision to a cataract patient. Without implantation of an IOL, after the removal of the lens, the patient will need strong glasses for life. It should be noted that licensed (official) IOLs are absolutely safe for the eyes and do not cause any discomfort. However, the lenses differ significantly from each other mainly in what kind of visual defects they eliminate. A large part of the cost of cataract surgery - phacoemulsification - is the cost of the lens itself.

As a rule, an artificial lens consists of two elements - optical and reference. The optical part of the artificial lens is a lens made of a transparent material that is biologically compatible with the tissues of the eye. A special diffraction zone is located on the surface of the optical part, which makes it possible to obtain a clear image. And the supporting part allows you to securely fix the artificial lens in the lens capsule of the human eye. Implantable intraocular lenses do not have an ""expiration date"" and do not require replacement, providing the necessary visual characteristics for many years.

An intraocular lens is implanted in place of the natural lens:

...

IOLs can be classified according to the following criteria:

By type of lens: hard and soft.

...

With or without preservation of the natural lens: phakic and aphakic.

...

According to the method of light refraction: spherical and aspherical.

...

According to the method of vision correction: monofocal and multifocal.

...

According to additional correction options: toric.

...

With protective functions: with color filters (yellow, blue, etc.).

...

With maximum effect: multifocal toric.

...

1.2. Assessment of factors affecting the market

Let us consider the main factors influencing the IOL market in India and, accordingly, the demand.

Economic

...

Data on the dynamics of GDP is a macroeconomic indicator that reflects the market value of all final goods and services (that is, intended for direct consumption) produced per year in all sectors of the economy on the territory of the state for consumption, export and accumulation.

Diagram 1. Dynamics of India's GDP, 2013-2018, in % to the previous year

The real incomes of the population determine the level of solvent demand.

...

Diagram 2. Dynamics of real money incomes of the population of India, 2013-2018, in % to the previous year

Socio-demographic

Over the past six years, India's population has been showing...

technological

The modern approach to the treatment of cataracts implies not only getting rid of the disease, but also obtaining the highest quality of visual life after surgery.

Political and legal

There are standards in the industry that govern the requirements for the production and technical characteristics of IOLs, which leads to the availability of products of sufficiently high quality on the market ...

1.3. Volume of domestic production

...

1.4. Share of exports in production

...

1.5. Market share of imports

...

1.6. Dynamics of market volume and capacity, 2013-2018 (2018 - forecast)

...

Diagram 12. Dynamics of the volume of the IOL market in India in value terms, 2013-2018, million Rs.

Diagram 13. Dynamics of the volume of the IOL market in India in natural terms, 2013-2018, thousand units

1.7. Market structure by types of products

...

Part 2. Analysis of imports in 2017

2.1. IOL import volume, 2017

...

2.2. Import structure:

2.2.1. By producing countries (in physical and value terms)

In 2017, the key manufacturing countries of IOLs imported to India …

2.2.2. By manufacturing companies (in physical and value terms)

Table 3. IOL imports in India by manufacturing companies, 2017

2.2.3. By recipient companies (in physical and value terms)

...

2.2.4. By trademarks (in physical and value terms)

...

2.3. Average import price

According to GidMarket estimates based on FCS data, at the end of 2017, the average IOL import price in India amounted to …

Part 3: Competitor Analysis

3.1. Major players in the market

Among the main players in the Indian IOL market, there are four foreign companies and two domestic manufacturers:

...

3.2. Market shares of the largest competitors

According to GidMarket, in 2017, the leader of the Indian IOL market was …

Part 4. Consumption analysis

4.1. Analysis of consumer preferences

According to GidMarket estimates, at the end of 2017, about ... of the Indian IOL market in value terms falls on public medical institutions, the remaining ... - on private medical clinics.

...

4.2. Dynamics of IOL implantation volume, 2013-2018 (2018 - forecast)

According to GidMarket estimates based on expert opinions, in 2017… IOL was implanted.

4.3. The volume of IOLs sold through tenders, 2013-2018 (2018 - forecast) by years (in physical and monetary terms)

According to GidMarket, the volume of IOLs sold through tenders is characterized by multidirectional dynamics during 2013-2018.

...

Part 5. Price Analysis

5.1. Prices for domestic IOLs

The Federal State Statistics Service does not provide aggregated data on the prices of domestic IOL manufacturers. Therefore, a request for prices from companies was carried out, as well as a search for data on their websites and industry portals.

...

5.2. Analysis of prices for imported products

GidMarket analysts analyzed prices for imported IOLs in 2017 according to customs statistics.

...

Part 6. Consumption forecast until 2022

...

Part 7. Recommendations and conclusions

...

Diagrams

Diagram 1. Dynamics of India's GDP, 2013-2018, in % to the previous year

Diagram 2. Dynamics of real money income of the population of India, 2013-2018, in % to the previous year

Diagram 3. The average nominal rate of Rs. to USD, 2013 – 9 months 2018

Diagram 4. Dynamics of the index of healthcare services in India, 2013-2018, in % of the previous year

Diagram 5. Population dynamics in India, 2013-2018, million people

Diagram 6. Volume of IOL production in India in value terms, 2017-2018, million Rs.

Diagram 7. Volume of IOL production in India in real terms, 2017-2018, thousand units

Diagram 8. The share of exports in the production of IOLs in India in value terms, 2017-2018, % and million Rs.

Diagram 9. The share of exports in the production of IOLs in India in physical terms, 2017-2018,% and thousand units

Diagram 10. Share of imports in the IOL market in India in value terms, 2017-2018, % and million Rs.

Diagram 11. The share of imports in the IOL market in India in real terms, 2017-2018, % and thousand units

Diagram 12. Dynamics of the volume of the IOL market in India in value terms, 2013-2018, million Rs.

Diagram 13. Dynamics of the volume of the IOL market in India in real terms, 2013-2018, thousand units

Diagram 14. Potential capacity of the IOL market in India in value terms, 2018, million Rs.

Diagram 15. Potential capacity of the IOL market in India in physical terms, 2018, thousand units

Diagram 16. The structure of the IOL market in India by type of product in value terms, 2017-2018, % and million Rs.

Diagram 17. The structure of the IOL market in India by type of product in natural terms, 2017-2018,% and thousand pcs.

Diagram 18. Shares of the largest competitors in the IOL market in India in value terms, 2017, % and million Rs.

Diagram 19. Shares of the largest competitors in the IOL market in India in real terms, 2017, % and thousand units

Diagram 20. Main IOL consumers in India in value terms, 2017, % and million Rs.

Diagram 21. Main consumers of IOLs in India in real terms, 2017, % and thousand units

Diagram 22. IOL consumer preferences in India by price segment, 2017, %

Diagram 23. Volume of implanted IOLs in India, 2013-2018, thous.

Diagram 24. The volume of IOLs sold through tenders, 2013-2018, thousand pcs.

Diagram 25. The volume of IOLs sold through tenders, 2013-2018, million Rs.

Diagram 26. IOL market forecast in India, 2018-2022, million Rs.

Tables

Table 1. STEP Analysis of Factors Affecting IOL Market in India

Table 2. Imports of IOLs in India by manufacturing country, 2017

Table 3. Imports of IOLs in India by manufacturing companies, 2017

Table 4. IOL imports in India by recipient companies, 2017

Table 5. IOL imports in India by brand, 2017

Table 6. Major players in the IOL market in India, 2017

Table 7. Pricing policy of Indian IOL manufacturers

Table 8. Prices for imported IOLs, 2017

Research benefits

The most complete presentation of information in an accessible and visual form. When ordering a marketing research, you can be sure of the accuracy and reliability of market information, which allows you to make informed management decisions and not miss the attractive opportunities that the market provides.

Directions for using the results of the study

To bring a new product to the market, organize a new production, correct the current strategy of the company or develop a new one, to make various decisions

Recommended

For senior and middle managers, marketing specialists, investors, business owners

Additional options

Create a customized ppt presentation

Extended update of the report ""according to the goals and objectives of the Customer""

Business plan development

All reports