Flat Glass Market Forecast in India

The relevance of research

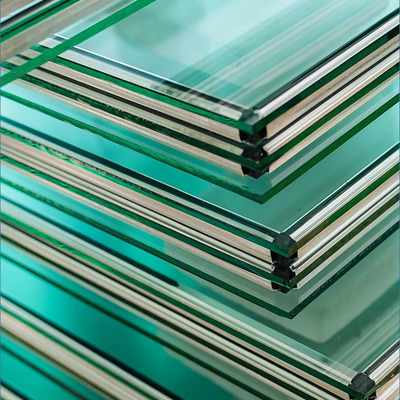

Flat glass production is the main product for specific sub-sectors that process flat glass. Sheet glass is processed for use in the automotive industry, in the glazing of rail cars, in the furniture industry, in agriculture for glazing greenhouses and, of course, in the construction industry for glazing industrial buildings and structures in housing construction

Purpose of the study

Analyzing the state of the float glass market in India, assessing the market size, analyzing competitors, and identifying factors affecting the float glass market

Content

Chapter 1. Key Components of the Flat Glass Market

1.1. Market size

1.2. Flat glass market growth rate

1.3. The ratio of imported and domestic products in the market

1.4. Volume and dynamics of sheet glass production

1.5. Import of sheet glass. Volume and dynamics

1.6. Export of sheet glass. Volume and dynamics

1.7. Share of exports in production

Chapter 2. Economic characteristics of the market

2.1. Flat glass market trends

2.2. The main problems of the industry

2.3. Estimation of the number of buyers and their financial capabilities

2.4. Estimated consumption per capita

2.5. Analysis of sectoral indicators of financial and economic activity

2.6. Compact location of industry companies in certain regions

2.7. Life cycle stage of the float glass market

Chapter 3

3.1. Economic components

3.2. Social Components

3.3. Technological components

3.4. Political Components

3.5. STEP-analysis of the flat glass market

Chapter 4. Assessment of the degree of competition

4.1. Scale of competition (local, regional, national, global)

4.2. Number of competitors and relative market shares of the largest competitors

4.3. Competition from substitute products

Chapter 5 Industry Forecasts

5.1. Analysis of the impact of recent crises on the industry (the global crisis of 2008 and the currency crisis in India in 2014)

5.2. Analysis of the impact on the state aid industry at the current date

5.3. Assessment of the degree of impact of the crisis due to covid-19 on the analyzed market. Barriers in the float glass market

5.4. Prospects and growth drivers for the float glass market

5.5. Forecast of the development of the flat glass market in the context of the current economic crisis due to covid-19

Chapter 6 Forecasting Methodology

6.1. Methods for forecasting key industry indicators

6.2. Sources of information for forecasting

6.3. Timing of forecasting

Research excerpt

Chapter 1. Key Components of the Flat Glass Market

1.1. Market size

Flat glass production is a staple for specific sub-sectors that recycle…

The spread of the coronavirus infection, the decline in oil prices, the devaluation of the rupee - all these events have had …

At the end of 2020, the volume of the flat glass market amounted to … mln sq. m. m or … billion Rs. The industry in question is …, nevertheless, enough … The volume of GDP in 2020 at current prices is … billion Rs. The share of the flat glass market was estimated to be …% of GDP.

1.2. Flat glass market growth rate

The growth rate of the market in the period of 2013-2020 allows us to state …

The dynamics of the indicator has … character: in 2015, the demand for flat glass …

Further up to 2018 the market is …%. In 2019, …% was recorded against the backdrop of a low base of …, as well as partial sales of ... The market volume in 2019 recovered to the level of … mln sq. m. m, which was still significant ...

According to the results of 2020, ... the flat glass market was noted - by ...% compared to 2019 or more ... The company partially compensated for the drop in domestic demand ...

1.3. The ratio of imported and domestic products in the market

Diagram 2. The ratio of imported and domestic products in the flat glass market, 2013–2020, %

The flat glass market in India is dominated by … products – the share of imports over the entire period shown in the diagram is …%, while the share of Indian-made glass is …

It should be noted that in the period from 2014 to 2016, the market showed a tendency towards partial … – the share of imports from …% in 2013 to …% in 2016, which was due to …

Despite the negative dynamics of the national currency exchange rate in 2020, the volume of imports …, while imports were on average … than in 2019 …

The main import of flat glass in India is ... glass, which ...

1.4. Volume and dynamics of sheet glass production

Diagram 3. Dynamics of flat glass production volumes in India, 2013–2020, million square meters m

Until 2013, various regions of India introduced ...

The maximum volume of sheet glass production in India during the period under review was reached in … year and amounted to … mln sq. m. m. Decrease in demand due to the economic crisis led to …%. Despite this, the so-called … market happened – an extremely undesirable situation for the industry. Glass manufacturers have worked ...

Further, up to and including 2019, we can say that the volume of production ... There was an increase in production volumes from ... This situation was largely facilitated by a high concentration ... At the moment, about ...% of the Indian market is firmly held by ...

The totality of negatively influencing factors of the next crisis in 2020 led to …% by … year, the volume amounted to … mln sq. m. m.

1.5. Import of sheet glass. Volume and dynamics

The dynamics of flat glass imports to India has … character. In the period from 2014 to 2016, the volume of …, which is due to … In 2016, … mln sq. m. Further, in 2017-2019, the volume of imports … According to the results of 2020, … mln sq. m of sheet glass, which is by …% … the level of 2019, but by …% …

1.6. Export of sheet glass. Volume and dynamics

...

1.7. Share of exports in production

The share of exports in the volume of domestic production of flat glass fluctuated in the period under review from …% to …%, while tending to …. For 7 years she...

Chapter 2. Economic characteristics of the market

2.1. Flat glass market trends

Among the main trends and trends in the float glass market, the following can be noted:

- The market is at the stage of …;

- Crisis phenomena…;

- To a large extent, the size of the market depends on ...

- ...

In the flat glass market in India, the balance of exports and imports is traditionally … In physical terms, the volume of exports ... At the end of 2020, the foreign trade balance amounted to … mln sq. m. m.

Diagram 7. Balance of exports and imports in 2015-2020, mln sq. m

2.2. The main problems of the industry

...

2.3. Estimation of the number of buyers and their financial capabilities

End-users in the float glass market can be…

For example, let's analyze the indicators that characterize the demand of the population.

During 2010-2018, there was an increase in the population. The growth of …% in 2015 compared to the previous year 2014 is due to … However, at the beginning of 2018, the population growth rate was …% compared to the previous year 2017, in 2019 (as of January 1.01.2019, 1) the population growth …, the level returned to the value of … years. As of January 2021, , …% was observed.

...

2.4. Estimated consumption per capita

The volume of consumption is calculated by GidMarket based on the ratio of volume …

The indicator tends to … except for … years. In 2020, consumption amounted to … sq. m/person, which is …% lower than in 2019. For the period since 2013 consumption …%.

2.5. Analysis of sectoral indicators of financial and economic activity

Important data for analyzing the state of the industry is the dynamics of such indicators as profitability, liquidity, and business activity. Let's take a look at the industry...

The table shows the dynamics of the gross profit margin (the ratio of gross profit to income).

Table 1. Gross Margin of the Flat Glass Industry Compared to All Industries in India, 2015-2020, %

For the period under review from 2015 to 2020, the dynamics of the gross margin in the float glass industry was …: up to and including 2018 …, in 2019 and 2020 … Nevertheless, in total for the period, the gross profit margin …% in 2015 to …% in 2020.

During the entire period, the gross margin in the industry under consideration was …

Consider the dynamics of profitability before tax.

Diagram 12. Profitability before tax (profit of the reporting period) in the flat glass industry in comparison with all sectors of the Indian economy, 2015-2020, %

In general, for the period, the profitability of profit before tax in the float glass industry …% in 2015 to …% in 2020. The work of the industry can be called ..., since the profitability is significantly ... indicator for all sectors of the Indian economy, in 2020 the difference was ... p.p.

Consider the liquidity ratios in the sheet glass industry. The indicator of current liquidity is ...

The estimated indicator of current liquidity of a normally operating solvent legal entity should be ...

...

At the same time, in world practice, it is considered optimal ...

For the industry under consideration, during the period from 2015 to 2020, the total coverage indicator ... The annual value of current liquidity is greater than ...

...

2.6. Compact location of industry companies in certain regions

Manufacturing sites of leading Indian manufacturers are located in 4 federal districts:

- … Union Territories occupies …% in the structure of float glass production, the main manufacturing companies are: …;

- … Union Territories occupies …% in the structure of float glass production, the main manufacturing companies are: …;

- ...

2.7. Life cycle stage of the float glass market

The float glass market is at the stage of ... the life cycle. At the same time, the quality of the product is on ... The product is presented ...

Sheet glass as a novelty product is already …

At this stage, the role of ...

The main task of the enterprise at this stage is ...

...

Chapter 3

Macroeconomic factors affect the dynamics of all sectors of the Indian economy, including the flat glass market. The main groups of factors are: economic, political, social and technological.

3.1. Economic components

GDP (gross domestic product) is used to determine the rate of economic development of any state. GDP is a macroeconomic indicator that reflects...

Chart 18 shows India's GDP growth rate from 2007 to 2020 at comparable prices (at 2016 prices).

The impact of the crisis, which began in 2008, led to a decrease in GDP by …% in 2009, but then the growth rates were quite high until 2012 inclusive.

Further, until 2014, the growth rate was ..., and in 2015 it was ... In 2015, which was the peak of the crisis in the state, the decline in GDP amounted to ...% compared to the previous 2014, and since the dynamics of GDP is directly proportional to the well-being of citizens , it speaks of...

In 2016 GDP …

...

The volume index of gross domestic product in 2020 amounted to …% compared to 2019.

3.2. Social Components

...

3.3. Technological components

...

3.4. Political Components

...

3.5. STEP-analysis of the flat glass market

Let's combine the conclusions on the influence of factors within the STEP-analysis.

Table 8. STEP Analysis of Factors Affecting the Flat Glass Market

According to the results of the performed STEP-analysis, macro-environmental factors have a greater influence on the float glass market.

Such economic factors as … have a negative impact on the development of the market.

Growth … have a positive impact on the development of the studied market.

A group of economic and technological factors have an ... influence on the market, other groups of factors have an ... influence on the market.

Chapter 4. Assessment of the degree of competition

4.1. Scale of competition (local, regional, national, global)

Global competition: On the one hand, the float glass market is not…

Currently, experts note the integration ...

National competition: expressed ... There are ...

Regional and local competition: …

4.2. Number of competitors and relative market shares of the largest competitors

The basis of the industry for the production of sheet glass in India is represented by ... large factories. They account for …% of the total volume produced in the country. The top five companies are:...

The flat glass market segment is … but limited in …

Diagram 23. Shares of the largest competitors in the flat glass market in 2020, %

Top-5 companies of the market occupy about …% in its structure. The leading players are: … with a share of …%, GK … with a share of …%, JSC “…” with a share of about …%, … Other manufacturers and importers account for …% of the market.

The degree of concentration of players in the market can be assessed using the Herfindahl-Hirschman index, an indicator used for …

For the flat glass market in 2020, the Herfindahl-Hirschmann index is ... - the market is ...

4.3. Competition from substitute products

Silicate glass has been used by people for centuries, not having a single analogue comparable in properties. However, glass has well-known disadvantages: ...

...

Chapter 5 Industry Forecasts

5.1. Analysis of the impact of recent crises on the industry (the global crisis of 2008 and the currency crisis in India in 2014)

In the first half of 2020, the flat glass market, like many other industries, felt the impact of the pandemic and the onset of the economic crisis.

Let us analyze data on the impact of recent crises on the industry (the global crisis of 2008 and the currency crisis in India in 2014).

Before the financial crisis of 2008, the global annual growth in demand for flat glass amounted to …%, which was driven by …

As for the Indian market, the average annual growth rate of the float glass market in 2003-2007 amounted to …%, in 2007 …

As stated earlier in 2015, the industry showed …

5.2. Analysis of the impact on the state aid industry at the current date

Forecasting the development of the flat glass market in India is impossible without understanding the economic situation in the country, as well as the impact of the spread of the covid-19 virus and the measures taken.

...

5.3. Assessment of the degree of impact of the crisis due to covid-19 on the analyzed market. Barriers in the float glass market

The glass industry is today the most important component sub-sector of production ...

In 2020, the number of events that influenced the real estate market was …

...

2020, unexpectedly for the market, is characterized by very high rates for …

The crisis of 2020 affected …% of developers. …

5.4. Prospects and growth drivers for the float glass market

...

5.5. Forecast of the development of the flat glass market in the context of the current economic crisis due to covid-19

...

Chapter 6 Forecasting Methodology

...

Diagrams

Diagram 1. Dynamics of the flat glass market volume, 2013–2020, million square meters m

Diagram 2. The ratio of imported and domestic products in the flat glass market, 2013–2020, %

Diagram 3. Dynamics of flat glass production volumes in India, 2013–2020, million square meters m

Diagram 4. Volume and dynamics of flat glass imports, 2013–2020, mln sq. m

Diagram 5. Volume and dynamics of flat glass exports, 2013–2020, mln sq. m

Chart 6. Share of exports in production, 2013–2020, %

Diagram 7. Balance of exports and imports in 2015-2020, mln sq. m

Diagram 8. Population dynamics in India as of January 1, 2010-2021, million people, %

Diagram 9. Population forecast in India for the period 2021-2024, million people

Diagram 10. Dynamics of real incomes of the population of India, 2011 - 2020, % to the previous year

Diagram 11. Volume of consumption in the flat glass market per capita, 2013–2020, sq. m/person

Diagram 12. Profitability before tax (profit of the reporting period) in the flat glass industry in comparison with all sectors of the Indian economy, 2015-2020, %

Diagram 13. Current liquidity (total coverage) for the flat glass industry for 2015–2020, times

Diagram 14. Business activity (average term of receivables turnover) in the field of flat glass, for 2015-2020, days days

Diagram 15. Financial stability (security of own working capital) in the field of flat glass, in comparison with all sectors of the Indian economy, 2015-2020, %

Diagram 16. Compact location of companies in the industry in certain regions, %

Figure 17. Life cycle stage of the float glass market

Diagram 18. Dynamics of India's GDP, 2007-2020, % to the previous year

Chart 19. Monthly dynamics of the US dollar against the rupee, 2015-2021 (Jan.-May), Rs. for 1 US dollar

Chart 20. Index of physical volume of retail trade turnover in India, 2014-2020, % of the previous year

Diagram 21. Dynamics of the volume of the real estate construction market in India in 2006-2020, billion Rs.

Chart 22. Dynamics of the size of the average interest rate on loans, 2015-2020 (Jan-Nov), years, %

Diagram 23. Shares of the largest competitors in the flat glass market in 2020, %

Chart 24. Problems faced by construction companies during the 2020 crisis, %

Diagram 25. Forecast of the volume of the real estate construction market in 2021–2025, billion Rs.

Diagram 26. Forecast of the flat glass market volume in 2021–2025, million square meters m.

Tables

Table 1. Gross Margin of the Flat Glass Industry Compared to All Industries in India, 2015-2020, %

Table 2. Absolute liquidity of the flat glass industry compared to all sectors of the Indian economy, 2015-2020, times

Table 3. Forecasts of various sources for real GDP in India in 2021-2023 (data for January-June 2021), %

Table 4. Average producer prices and CPI for electricity at the end of the period in 2017-2020, rupees, %

Table 5. Urban and rural population in India in 2014-2020 (as of January 1), million people, %

Table 6. Producer price indices for construction products in 2017 - 2020, % compared to December of the previous year

Table 7. Weighted average interest rates of credit institutions on credit operations in rupees, excluding PJSC Sberbank (% per annum), 2015-2020 (Jan-Nov)

Table 8. STEP Analysis of Factors Affecting the Flat Glass Market

Table 9. Main companies participating in the flat glass market in 2020

Table 10. Flat glass substitute products

Table 11. Assessment of the impact of recent crises on the industry

Table 12. Analysis of the impact on the industry of the state aid proposed to date

Table 13. Forecast indicators of the development of the Indian economy until 2024 (base case), units rev.

All reports