Analysis of the printing services market in India

The relevance of research

Indian printing industry is one of the most high-tech and fastest growing industries in the country. These are not only state unitary enterprises, but also private printing houses, actively gaining positions in the market of paper and printing products.

Purpose of the study

Analysis of the state of the printing services market, assessment of the market size, analysis of competitors, as well as identification of factors affecting the printing services market.

Content

Part 1. An overview of the Indian printing services market

1.1. Definition and Characteristics of the Indian Printing Services Market

1.2. Dynamics of the volume of the Indian printing services market, 2013-2017

1.3. Market structure by type of service provided in India

1.4. The structure of the printing services market by the Union Territories

1.5. Assessment of current trends and development prospects of the studied market

1.6. Assessment of factors affecting the market

1.7. Analysis of sectoral indicators of financial and economic activity

Part 2. Competitive analysis in the printing services market in India

2.1. Major players in the market

2.2. Market shares of the largest competitors

2.3. Profiles of major players

Part 3. Analysis of the consumption of printing services

3.1. Estimated consumption of printing services per capita

3.2. Market Saturation and Estimated Market Potential in India

3.3. Description of consumer preferences

3.4. Price analysis

Part 4. Assessment of factors of investment attractiveness of the market

Part 5. Forecast for the development of the printing services market until 2022

Part 6. Conclusions on the prospects of creating enterprises in the study area and recommendations for current market operators

Research excerpt

Part 1. An overview of the Indian printing services market

1.1. Definition and Characteristics of the Indian Printing Services Market

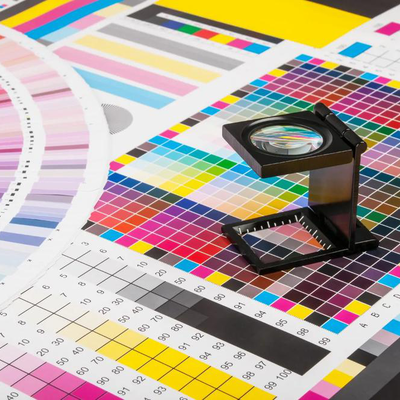

Indian printing industry is one of the most high-tech and fastest growing industries in the country. These are not only state unitary enterprises, but also private printing houses, actively gaining positions in the market of paper and printing products.

Diagram 1. Market structure by type of organizations providing printing services

The number of small and mini enterprises in the printing industry with the number of employees less than ... people. is …%, where the main share falls on printing houses with the number of … employees. If we do not take into account the number of small enterprises in the structures of commodity-service fields of activity, then on this basis, the printing industry is at the top of the scale among the main industrial sectors.

Diagram 2. Structure of enterprises by size, %

1.2. Dynamics of the volume of the Indian printing services market, 2013-2017

Consider the dynamics of changes in the volume of the printing services market in India for the period 2013 - 2017.

Diagram 5. Dynamics of the volume of the printing services market in India, 2013-2017, billion Rs.

In physical terms, the volume of the printing services market since 2014 has been unchanged … . It noted…

Diagram 6. Dynamics of the volume of the printing services market in India, 2013-2017, billion units

In terms of types of printing services, the dynamics of the market looks different. So the volume of newspaper products, books and magazines produced during 2014-2017. dwindled...

1.3. Market structure by type of service provided in India

In the structure of the printing services market in 2017, …

1.4. The structure of the printing services market by the Union Territories

At the end of 2017, the main share of printing services falls on …

Diagram 8. The structure of the provision of printing services in India by Union Territories, %

1.5. Assessment of current trends and development prospects of the studied market

At present, in the field of media printing, the preservation of the state printing potential is of particular relevance ...

1.6. Assessment of factors affecting the market

Let's consider the main factors influencing the market and, accordingly, demand.

Social (demographic)

During 2011-2017 India's population is on the rise. The increase in the population in 2014 occurred not only due to migration and natural increase, but also due to the formation of two new states of the Federation - the Republic of Crimea and the city of Sevastopol. Wherein, …

Chart 9. Population change in India, 2011-2017

1.7. Analysis of sectoral indicators of financial and economic activity

Consider the financial and economic indicators for the printing services industry (18.1) in comparison with the indicators for all sectors of the Indian economy, in dynamics, for 2013-2017.

...

Part 2. Competitive analysis in the printing services market in India

2.1. Major players in the market

The largest players in the printing services market are…

2.2. Market shares of the largest competitors

At the moment, the market leader in printing services is ...

...

2.3. Profiles of major players

Basic information about the participant No. 1 of the printing services market

...

Basic information about the participant No. 2 of the printing services market

...

Basic information about the participant No. 3 of the printing services market

...

Basic information about participant No. 4 of the printing services market

...

Basic information about participant No. 5 of the printing services market

...

Part 3. Analysis of the consumption of printing services

3.1. Estimated consumption of printing services per capita

During 2013-2017 the volume of consumption of printing services per capita was oscillatory: 2013-2015. the value of the indicator grew, and in 2016-2017. - decreased. In 2017, the volume of consumption of printing services per capita amounted to … Rs./person, which is by …% … the value of the indicator in 2016. Relative to 2013, the volume of consumption of printing services per capita in 2017 was … by …%.

Diagram 15. Consumption of printing services per capita, 2013-2017, Rs./person

3.2. Market Saturation and Estimated Market Potential in India

Today, the market for printing works has already formed and is quite saturated. It consists of several parts: federal, interregional and regional components. Individual printing companies are present in all parts of the market, while other printing houses are characterized by a limited scope of activity ...

3.3. Description of consumer preferences

Considering the market as a heterogeneous structure that can change under the influence of both consumer properties of the product.

3.4. Price analysis

Prices for printing services depend on many factors: ...

Part 4. Assessment of factors of investment attractiveness of the market

...

Part 5. Forecast for the development of the printing services market until 2022

The further development of the printing services market will largely be determined by the gradual normalization of the economic situation in India, the stabilization of the rupee against the background of a moderate increase in oil prices and the growth of business confidence ...

Part 6. Conclusions on the prospects of creating enterprises in the study area and recommendations for current market operators

The modern printing industry is not among the priority areas for the development of the country's economy, but retains its importance in the common economic space...

Diagrams

Diagram 1. Market structure by type of organizations providing printing services

Diagram 2. Structure of enterprises by size, %

Diagram 3. Distribution of answers to the question ""How do you assess the current state of the industry (in ruble terms)?""

Diagram 4. Distribution of answers to the question ""How do you assess the industry's prospects?""

Diagram 5. Dynamics of the volume of the printing services market in India, 2013-2017, billion Rs.

Diagram 6. Dynamics of the volume of the printing services market in India, 2013-2017, billion units

Diagram 7. Structure of the printing services market by type, %

Diagram 8. Structure of printing services in India by Union Territories, %

Diagram 9. Population change in India, 2011-2017

Diagram 10. Dynamics of India's GDP, 201-2018 (March), % to the previous year

Diagram 11. The dynamics of the US dollar against the rupee, Jan. 2015-Jul. 2018, Rs. for 1 US dollar

Diagram 12. Dynamics of the inflation rate in India, 2011-2018st half of

Diagram 13. Dynamics of the average interest rate on loans to legal entities, 2013-Jan-May 2018

Diagram 14. Shares of the largest competitors in the printing services market in India in 2017, %

Diagram 15. Consumption of printing services per capita, 2013-2017, Rs./person

Diagram 16. The largest share in the structure of clients of the printing house, %

Diagram 17. Factors that matter most to the consumer when choosing a printing company, %

Diagram 18. Forecast of the volume of the printing services market in 2018 - 2022, billion Rs.

Tables

Table 1. The volume of the market for certain types of printing services in physical terms, 2013-2017

Table 2. Industrial production index by states of India (in % of the previous year), 2012 - H2018

Table 3. The dynamics of the US dollar against the rupee, Jan. 2015-Jul. 2018, Rs. for 1 US dollar

Table 4. Dynamics of the inflation rate, the refinancing rate of the Central Bank of India and the key rate of the Central Bank of India, 2011-Jul. 2018

Table 5. Weighted average interest rates of credit institutions on loans to legal entities in rupees (% per annum), 2013-Jan-May 2018

Table 6. STEP-analysis of factors influencing the printing services market

Table 7. Profit (loss) from the sale of printing services for the period 2013 - 2017, thousand Rs.

Table 8. Gross margin of the printing services industry in comparison with all sectors of the Indian economy, 2013-2017, %

Table 9. Profitability of profit before tax (profit of the reporting period) in the field of printing services in comparison with all sectors of the Indian economy, 2013-2017, %

Table 10. Current liquidity (total coverage) in the field of printing services for 2013-2017, times

Table 11. Absolute liquidity in the printing services sector in comparison with all sectors of the Indian economy, 2013-2017, times

Table 12. Business activity (average term of receivables turnover) in the field of printing services, for 2013-2017, days.

Table 13. Financial stability (security of own working capital) in the field of printing services, in comparison with all sectors of the Indian economy, 2013-2017,%

Table 14. The main companies participating in the printing services market in 2017

Table 15. Dynamics of revenue volume of the largest operators of the printing services market (TOP-5) in India, 2013-2017, billion Rs.

Table 16. Consumer price indices for printing services in India in 2013-June 2018, %

Table 17. Factors of investment attractiveness of the printing services market

All reports