Analysis of corrugated paper market in India

The relevance of research

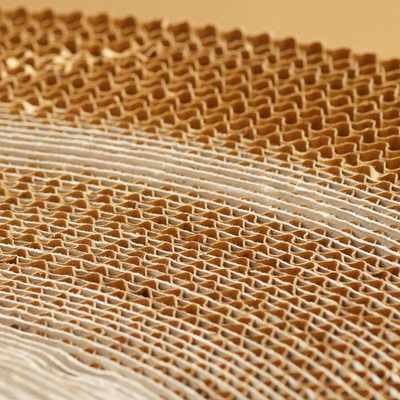

Corrugated cardboard packaging is in stable, ever-increasing demand in the Indian market, it packs a variety of product groups: gifts, food and drinks, electronics, toys, perfumes and cosmetics, auto parts, clothes, shoes and much more. Accordingly, the demand for raw materials and materials used for its manufacture is growing, one of which is corrugated paper - this is paper intended for the manufacture of internal corrugated layers used in the production of corrugated board

Purpose of the study

Analyzing the state of the corrugated paper market in India, assessing the market size, analyzing competitors, and identifying factors affecting the corrugating paper market

Content

Part 1. Overview of the Indian corrugated paper market

1.1. Main characteristics of the market

1.2. Corrugating Paper Market Volume Dynamics 2017-2021 Potential market capacity

1.3. Assessment of factors affecting the market

1.4. Corrugated Paper Market Life Cycle Stage

1.5. Competition from substitute products

Part 2: Competitive Analysis of the Corrugated Paper Market

2.1. Major players in the market

2.2. Market shares of the largest competitors

2.3. Profiles of major players

Part 3: Corrugated paper production analysis

3.1. Volume and dynamics of domestic production of corrugated paper

3.2. Share of exports in corrugating paper production

3.3. Segmentation of corrugated paper production by regions

3.3.1. Production by Union Territories

3.3.2. Production by states of India

Part 4. Analysis of foreign trade supplies of corrugating paper

4.1. Volume and dynamics of corrugated paper imports

4.2. Import structure

4.3. The volume and dynamics of corrugating paper exports

4.4. Export structure

Part 5: Corrugating Paper Consumption Analysis

5.1. Corrugating Paper Consumption Dynamics

5.2. Analysis of the results of tenders for the purchase

Part 6. Price Analysis

6.1. Average producer prices by union territories

6.2. Average consumer prices by states in India

Part 7. Assessment of factors of investment attractiveness of the market

Part 8. Corrugated paper market forecast up to 2026

Part 9. Recommendations and conclusions

Research excerpt

Part 1. Overview of the Indian corrugated paper market

1.1. Main characteristics of the market

Corrugated cardboard packaging is in stable, ever-increasing demand in the Indian market, it packs a variety of product groups: ... Corrugated paper, the raw material for which is semi-cellulose or waste paper, is called fluting in the Western world. She is usually…

Quite high requirements are imposed on the physicochemical and mechanical properties of corrugated paper, because these parameters determine the protective characteristics of corrugated cardboard: ...

The main document regulating the production of corrugated paper ...

...

Indian manufacturers produce four types of corrugated paper under alphanumeric designations…

Indian corrugating paper companies sell more than …% of their own corrugated paper in the domestic market, shipping …

As can be seen in diagram 1, the share of domestic products in the corrugating paper market in the study period averages …%. The main production is located in ... federal districts.

Diagram 1 also shows that the share of imports …: the maximum indicator is …% in 20…, followed by an annual decrease in the share of imports in the market, and in 2021 the indicator reaches …

Diagram 1. The ratio of imported and domestic products in the corrugating paper market,%

1.2. Corrugating Paper Market Volume Dynamics 2017-2021 Potential market capacity

Consider the volume dynamics of the Indian corrugating paper market in 2017-2021.

Chart 2. Corrugating paper market volume dynamics, 2017-2021

The dynamics of the volume of the Indian corrugating paper market in real terms during the analyzed period has … developments. The maximum increase in the market volume was recorded in 2021 and amounted to …%, the maximum value of the market volume also reached in 2021 and amounted to … thousand tons. Experts and analysts note that the coronavirus pandemic contributed to ... In 2020-2021. There has also been an increased demand for…

The minimum value of the market volume falls on 2017 with an indicator of … thousand tons. GidMarket analysts assume that in the coming years the Indian corrugating paper market will have …% per year. Market potential … due to the above factors. The volume of consumption of corrugating paper increases annually, according to the forecast of analysts from GidMarket, by 2026 the market volume will amount to … thousand tons. In addition, the volume of production of corrugating paper will also increase due to …

In the structure of proceeds from the sale of paper for corrugating across the union territories, the absolute leader is … the federal district, its share ranges from …% to …% in the study period. It should be noted that the production facilities of many market participants are located in the … federal district. In second place in terms of proceeds from the sale of paper for corrugating … is the federal district, its share during the study period remains virtually unchanged and amounts to …%. The top three in terms of revenue from the sale of corrugating paper is closed by …

...

1.3. Assessment of factors affecting the market

The production of paper for corrugating belongs to the pulp and paper industry, one of the leading branches of the forest complex. The industry uses the most technologically sophisticated and expensive equipment that produces products with maximum …

Let's look at the main factors influencing the market and, accordingly, the demand for corrugated paper in India.

Economic:

- decrease in real incomes of the population – …;

- consumption growth …;

- financial…;

...

Political:

...

Technological:

...

Social:

...

Table 1 STEP Analysis of Factors Affecting Corrugated Paper Market

Based on the results of the analysis of the factors influencing the corrugated paper market in India, there is a prevailing ... influence of the main number of factors on the market, and, accordingly, on demand.

Significant limiting factors include…

The following economic and political factors have a stimulating effect on the analyzed market: ...

It is also worth noting the positive impact of such a factor as support measures …

1.4. Corrugated Paper Market Life Cycle Stage

...

1.5. Competition from substitute products

...

Part 2: Competitive Analysis of the Corrugated Paper Market

2.1. Major players in the market

The Indian corrugated paper market has more than ... enterprises of various sizes: there are both large pulp and paper mills producing corrugating paper from semi-pulp, and ...

The main players in the market can be considered 8 enterprises presented in Table 2.

As a rule, the main activities of such companies are the production of paper and cardboard, the production of pulp and wood pulp, the production of corrugated paper and cardboard. At the same time, it should be noted that corrugated paper manufacturers also often produce their own …

Separately, it should be noted that LLC “…” and LLC “…” are located on …

2.2. Market shares of the largest competitors

Chart 4. Shares of the largest competitors in the corrugated paper market in 2021

The market shares of the largest market operators are calculated based on the revenue of such enterprises from …

The market leader is JSC “…”, the market share of the company is …%. In second place is JSC “…”, the shares of these companies amount to …% for each. The top three is closed by “…” LLC and “…” JSC, the shares of these companies in the market amount to …% each. Share ... At the same time, it should be noted that for some market leaders, the production of corrugated paper is a relatively new line of business ... The aggregate share of the largest enterprises is ...%, the aggregate share of other enterprises is ...%, while it should be noted that the share of each less than …% of such enterprises.

2.3. Profiles of major players

Part 3: Corrugated paper production analysis

3.1. Volume and dynamics of domestic production of corrugated paper

According to Rosstat and GidMarket analysts, the volume of corrugated paper production in India in 2021 amounted to … thous.

The dynamics of corrugating paper production in India has a stable … in the study period with an average annual increase of …%. The minimum value of the production volume falls on … and amounts to … thousand tons, while the increase to the production volume in 2016 amounted to …%. The production volume reached its maximum value in 2021 with a record increase compared to 2020 in ... due to the possibility of its ... Export of corrugated paper made in India ...

Corrugated paper market volume correlates with … dynamics, except for 2020, when … increased sharply.

The top 5 players in the corrugated paper market in India include the largest manufacturers: …

Diagram 6 shows the dynamics of the total revenue of the largest market players for all types of activities of these enterprises. All TOP-5 enterprises are large producers, in addition to corrugating paper, they produce … The revenue of all TOP-5 enterprises has multidirectional dynamics throughout the study period, while all TOP-5 players have a clear ... The maximum increase in revenue falls on 2018 and amounts to …% by 2017, then the growth rate is …

3.2. Share of exports in corrugating paper production

Share of exports in corrugating paper production in India in 2017-2019 was quite …, its values fluctuated within …%, in 2020 the share of exports in production increased to …%, in 2021 the indicator reached … values of …%, while we can talk about a trend towards further …

3.3. Segmentation of corrugated paper production by regions

Consider the segmentation of corrugated paper production by regions of India based on production volumes.

3.3.1. Production by Union Territories

Table 4. Corrugated Paper Production in India by Union Territories

The development of corrugated paper production by Union Territories reflects the overall production development of India as a whole.

In terms of production volume of this type of product, … the federal district is leading, which is due to the presence of large manufacturers in this federal district, such as … …% to the indicators of the previous year. In second place ... In third place ... the federal district, where the production facilities of market leaders JSC ""..."" are located ...

3.3.2. Production by states of India

The main manufacturers of corrugating paper (TOP-5) are located in …, … regions and the Republic of …

... the federal district is represented by enterprises in ... regions, it is in this federal district that the largest number of enterprises producing paper for corrugating of various sizes. The share of production volume of enterprises …%. The Volga Federal District is represented by enterprises …

It is worth noting that corrugated paper production facilities are present in many states of India, while their production volumes are …

Part 4. Analysis of foreign trade supplies of corrugating paper

4.1. Volume and dynamics of corrugated paper imports

The share of imports in the corrugated paper market during the study period is …, on average it is …%, while in 2020-2021 it decreases and has a further trend towards ... The volume of imports in the study period has multidirectional dynamics: in 2017-2018 gg. dynamics … The maximum import volume of paper for corrugating falls on … years – … tons, the increase compared to 2017 is …%. At the same time, it should be noted that the dynamics of corrugating paper import volumes in monetary terms correlates with …

The decrease in import volumes both in kind and in monetary terms during the study period was influenced by such factors as an increase in …

4.2. Import structure

Table 5. Corrugating paper import structure by importing countries in 2021

In the structure of imports of corrugating paper by country, the absolute leader is ... with a share of ...% of the total import volume into the country, which is due to the availability of production capacities for the production of corrugating paper, its quality, as well as a decrease in imports from ... in 2020-2021. Followed by…

As previously mentioned, the import share of the Indian corrugated paper market is…

4.3. The volume and dynamics of corrugating paper exports

...

During 2017-2021 the volume of corrugated paper exports from India has … dynamics, but in general, a clearly positive development trend is an increase in 2017-2018. is changing...

The maximum value of exports in physical terms falls on … years and amounts to … tons, while the volume of exports in monetary terms in 2021 also increased and reached ... The minimum export value of corrugating paper in physical terms falls on … years. and amounts to ... t., the minimum value of exports in monetary terms also falls on ...

The difference between exports and imports - the trade balance - is the annual rate of consolidation of a country's foreign trade transactions. …

The volume of corrugated paper imports to India remains …, the share of exports in production is …, in 2021 it is significant – …%, respectively, the trade balance is …

... - all this suggests that production, having satisfied the needs of the domestic market, is actively ...

4.4. Export structure

Indian corrugated paper is exported mainly to …, countries … In 2021, export deliveries were made to … country.

The maximum amount of paper for corrugating in … was purchased from India by …, the share in the total export amounted to …%. In second place is … with a share of …%, third place is occupied by …

Part 5: Corrugating Paper Consumption Analysis

5.1. Corrugating Paper Consumption Dynamics

The dynamics of consumption of paper for corrugating in the domestic market of India in the study period is calculated taking into account current prices, as well as their changes in …

The dynamics of consumption of corrugating paper has …, the average annual increase, taking into account the decrease in consumption in 2020, is …%. The reasons for the increase in consumption are associated with an increase in online trading and delivery ...

5.2. Analysis of the results of tenders for the purchase

In 2020-2021 ... tenders were held for the purchase of corrugating paper for a total amount of ... thousand rupees.

The maximum amount of the contract is … thousand rupees, the customer is JSC “…”, the purpose of the contract is the supply of paper for corrugating production “…” in the amount of … tons, the supplier is …

...

Part 6. Price Analysis

6.1. Average producer prices by union territories

Corrugated Paper Producer Average Prices Are Shown By ...

The average price of corrugated paper in all union territories in 2021 was ... rupees per ton, the maximum price was ... rupees - in the ... federal district. The minimum level - ... rupees per ton - in ... the federal district. At the same time, the maximum price is slightly higher than the average price per ton of corrugated paper in India.

On average, in India, the producer price for corrugating paper increased by …% in 2021, while the increase in prices across the union territories amounted to …

6.2. Average consumer prices by states in India

The average retail price for corrugated paper is calculated by GidMarket analysts in accordance with the average price of manufacturers and the normal …

The average price per ton of corrugated paper in India in 2021 is … rupees. The maximum cost of a ton of corrugating paper from Indian manufacturers in all states represented is … rupees and is fixed in … Autonomous Region, which is due to …

Part 7. Assessment of factors of investment attractiveness of the market

… the investment climate factors of the corrugated paper market dominate over… A comprehensive assessment of investment attractiveness factors amounts to … points – … investment climate.

negative factors. …

The most significant positive factors. …

Part 8. Corrugated paper market forecast up to 2026

...

Part 9. Recommendations and conclusions

...

Diagrams

Diagram 1. The ratio of imported and domestic products in the corrugating paper market,%

Chart 2. Corrugating paper market volume dynamics, 2017-2021

Diagram 3. Revenue (net) from the sale of corrugating paper by union territories for 2017-2021, %

Chart 4. Shares of the largest competitors in the corrugated paper market in 2021

Chart 5. Dynamics of corrugated paper production in India for 2017-2021

Chart 6. The dynamics of the total revenue of the largest manufacturers (TOP-5) of corrugated paper in India, 2017-2021

Diagram 7. The share of exports in production for 2017-2021

Diagram 8. Volume and dynamics of corrugating paper imports in physical terms

Diagram 9. Volume and dynamics of corrugating paper imports in monetary terms

Diagram 10. Dynamics of export of paper for corrugating in physical terms

Diagram 11. Dynamics of corrugating paper export in monetary terms

Diagram 12. Balance of exports and imports

Chart 13. Structure of exports by country in 2021

Diagram 14. Corrugating paper consumption dynamics in monetary terms, 2017-2021

Diagram 15. Forecast of market size in 2022-2026

Tables

Table 1 STEP Analysis of Factors Affecting Corrugated Paper Market

Table 2. Main companies participating in the corrugated paper market in 2021

Table 3. Profiles of companies participating in the corrugated paper market in 2021

Table 4. Corrugated Paper Production in India by Union Territories

Table 5. Corrugating paper import structure by importing countries in 2021

Table 6. Data on tenders for the purchase of corrugating paper held in 2020-2021

Table 7. Average Producer Prices on the Corrugated Paper Market by Union Territories

Table 8. Average Consumer Prices in the Corrugated Paper Market by State of India

Table 9. Assessment of factors of investment attractiveness of the corrugating paper market

All reports